EXPLAINER: What’s Going on with Student Loan Forgiveness?

Currently, the student aid government website states: Student Loan Debt Relief is Blocked.

"Courts have issued orders blocking our student debt relief program. As a result, at this time, we are not accepting applications. We are seeking to overturn those orders."

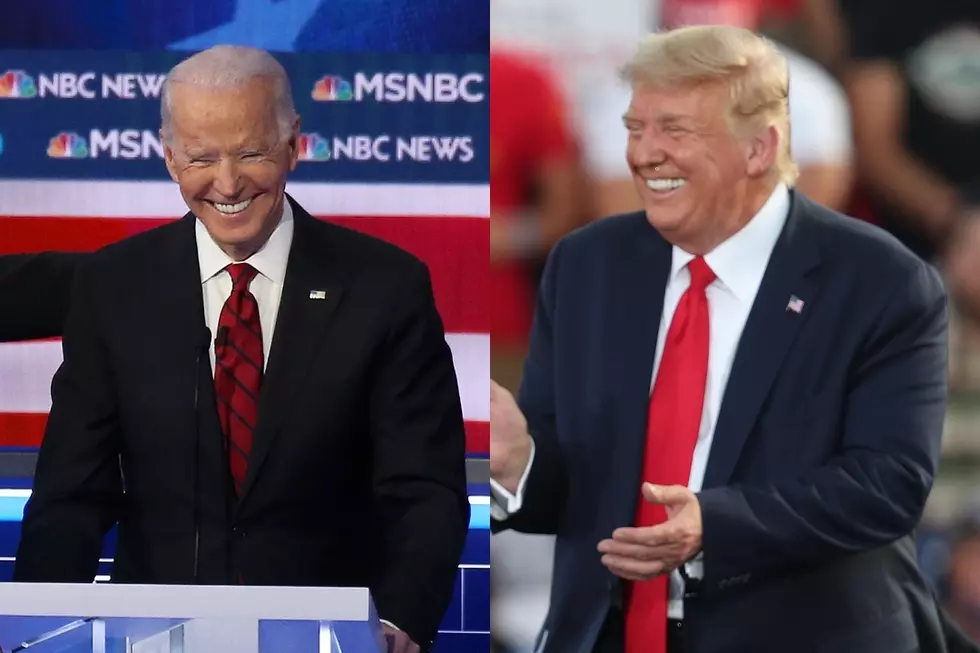

Legal challenges have paused the president's plans to go forward with student loan forgiveness.

The nine justices of the U.S. Supreme Court have scheduled arguments against Biden's student loan forgiveness plan for Feb. 28 as many law suits have been filed against it, including six states: Nebraska, Missouri, Arkansas, Iowa, Kansas, and South Carolina.

Around 26 million borrowers applied for the student debt cancellation that was announced in August.

"It would be deeply unfair to ask borrowers to pay debt they wouldn’t have to pay, were it not for meritless lawsuits," wrote Secretary of Education Miguel Cardona in a January news release.

The plan was announced in August.

It would cancel $10,000 in student loan debt for those making less than $125,000 or households with less than $250,000 in income.

The Congressional Budget Office has said the program will cost about $400 billion over the next three decades.

The cancellation applies to federal student loans used to attend undergraduate and graduate school, along with Parent Plus loans.

Current college students qualify if their loans were disbursed before July 1.

The plan makes 43 million borrowers eligible for some debt forgiveness, according to the administration. This per the Associated Press.

The announcement immediately became a major political issue ahead of the November midterm elections.

Time will tell whether or not 20 million people could get their debt erased entirely.

Holidaze of Blaze Tour with Snoop Dogg, Warren G, Ying Yang Twins and Charlemagne

More From 104.7 KISS-FM